Your Critical Illness Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Critical Illness Insurance: When you, your spouse, or child is diagnosed with a covered condition, you can receive cash benefits to help cover the unexpected costs not covered by your health plan. Critical Illness Insurance benefits can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you. What’s more, all family members on your plan are eligible for a wellness-screening benefit, also paid directly to you once each year per covered person.

You can elect to cover yourself, your spouse, and your children up to age 26.

Contributions & Rates

Voluntary Critical Illness Insurance is 100% employee funded. Please check bswift for premium information

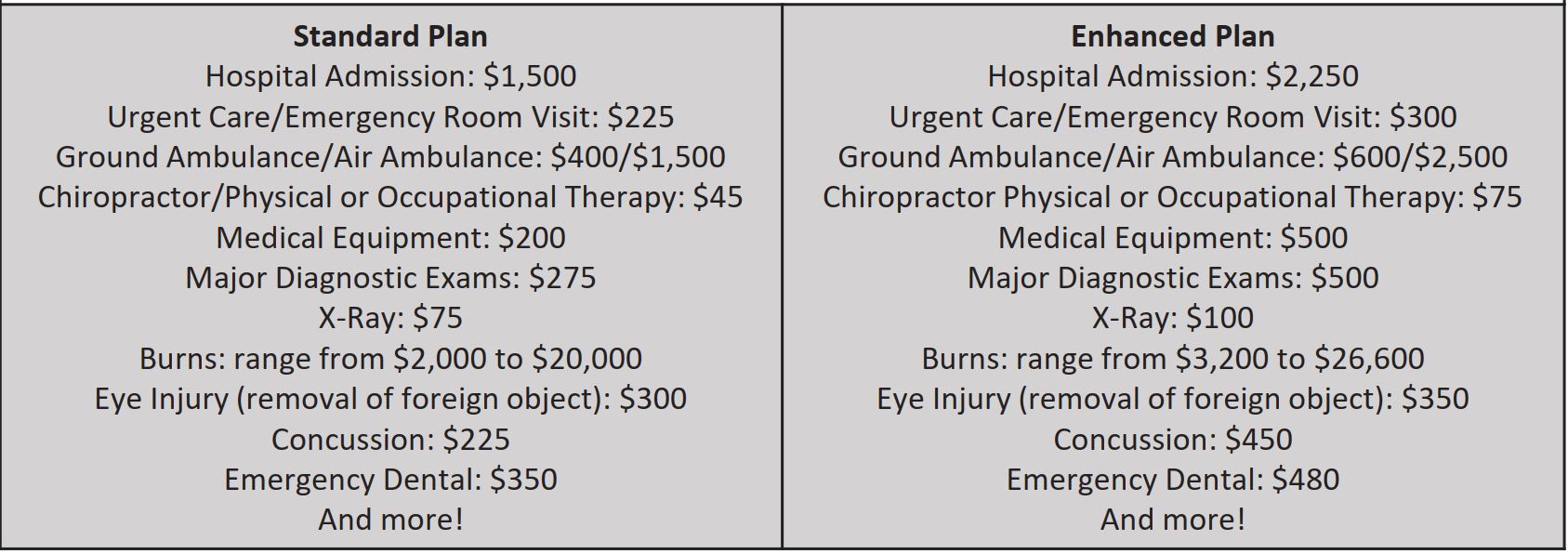

Your Accident Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Accident Insurance: When you, your spouse, or child has a covered accident, like a fall from a bicycle that requires medical attention, you can receive cash benefits to help cover the unexpected costs. You can use accident benefits to help cover related expenses like lost income, child care, deductibles, and co-pays. Accident benefits can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you.

You can elect to cover yourself, your spouse, and your children up to age 26.

Your employer offers you a choice of (2) plans.

Contributions & Rates

Voluntary Accident Insurance is 100% employee funded. Please check bswift for premium information

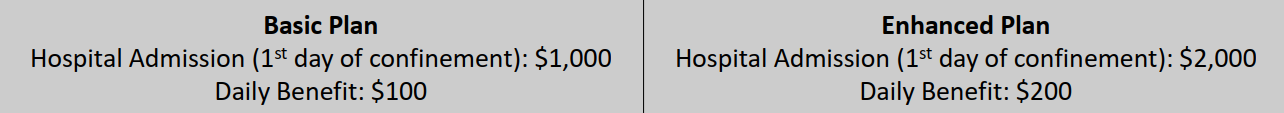

Your Hospital Indemnity Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Hospital Confinement Indemnity Insurance provides a daily fixed indemnity benefit for eligible hospital confinements. Employees can use the benefit as they choose – for instance, to help offset copays, coinsurance or deductibles that may be tied to a hospitalization or lost time from work.

You can elect to cover yourself, your spouse, and your children up to age 26.

Your employer offers you a choice of (2) plans.

Contributions & Rates

100% employee funded.

Voluntary Pet Insurance

PLEASE NOTE:

When filing a claim for your pet- medical history will be required to be submitted to Nationwide for review.

Eligibility

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

You may purchase voluntary pet insurance coverage on dogs, cats, avians, and exotic pets. Discounts are given for insuring more than one pet per owner. Premiums can be paid through payroll deductions. Employees opting for this coverage will be required to complete paperwork to provide directly to the insurer. To enroll click on the pet insurance link below.

New Benefit! Wellness rider now available.

Get reimbursed for giving your animal it routine care.

- Annual Exams

- Vaccinations

- Nail Trimming

- Flea & Tick control

- And a whole lot more!

To enroll in Pet Insurance click here to get started.

* Mention you are an employee of Northeastern Vermont Regional Hospital, and you will receive a discount on your policy.

Helpful Resources

Contributions

Voluntary Pet Insurance is 100% employee funded.

Your Voluntary Identity Theft Protection Benefits

Eligibility

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

NVRH offers ID Theft Protection as a voluntary benefit. Employees can optionally purchase these benefits post-tax for themselves and their dependents.

Stay protected and gain peace of mind with ID Watchdog

Most victims only discover they have a problem when they are denied credit, denied employment, contacted by police, or receive unknown bills. With ID Watchdog’s protection plans you will receive…

• Single-bureau or tri-bureau credit monitoring and alerts.

• High-risk transaction monitoring.

• Fully managed resolution services to manage your case until it is completely restored.

• 24/7 access to our Customer Care advocates.

Contributions

ID Watchdog Services are 100% employee paid

*Upon termination, this benefit is portable

Helpful Resources

Carrier Service Contact

24/7 U.S. Based Customer Care Center

Forms and Plan Documents

529 College Savings Plan

Eligibility

Employees are eligible to particpate on the first of the month following 30 days of service.

Our plan is managed by American Funds

With college costs rising faster than inflation, many students need assistance paying for their higher education. To help you save for this important goal, your employer, working alongside a financial advisor, is offering you a CollegeAmerica 529 plan as part of your benefits package.

With CollegeAmerica, you get some great benefits:

• Tax-advantaged investing — Earnings in a 529 account grow free from federal tax. This can help you accumulate more over the long term.

• Flexibility — You can use the assets in your account to fund expenses at any U.S. public or private college — undergraduate, graduate, professional or vocational. Qualified expenses include tuition, fees, room and board, and many more.

• Investing for any beneficiary — You can save for anyone — your children, grandchildren, nieces, nephews, friends, etc. You can even save for yourself. In addition, there are no age or income limits.

• Convenience of automatic investing — You easily invest on a regular basis through deductions from your personal bank account or payroll deductions (if available). For details, talk to your employer.

• Low plan costs — You never pay a sales commission, and you benefit from low operating expenses. That way more of your money goes toward pursuing your goal.

• Control over your account — Unlike other college funding vehicles, you always control the assets in a 529, even when your beneficiary reaches the age of enrollment.

Please visit the Edward Jones website to locate a financial advisor. There are several in the Northeast Kingdom who can assist you with the 529 Plan enrollment process! https://www.edwardjones.com/us-en

Loan Repayment and Consolidation

EXCITING BENEFIT FOR EMPLOYEES!

The Northeastern Vermont Regional Hospital tuition assistance program is designed to help NVRH employees pay back student loan debt and improve their financial well-being.

Utilizing Northeastern Vermont Regional Hospital’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit the website below:

Eligibility:

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

- Minimum age requirement: In order to participate in the plan, you must be at age 21.

Helpful Resources

Gradfin Education Week Recorded Presentations:

*PLEASE BE SURE TO TYPE THE PASSCODE, DO NOT COPY AND PASTE*

In-School Origination / FAFSA

Meeting Recording:

https://zoom.us/rec/share/qUaIwAgKCwOgyayemkdeWGfbPXmMwxerJJx5KcHkau57bfpkDHyudoo9B4_a3Sx0.hFpuh2ZiiN2UF7Gn

Access Passcode: b*4=bK4U

ABC’s of Student Loans

Meeting Recording:

https://zoom.us/rec/share/eI2NzRh40UV48xCXg24JLhF1Vj9B7NjmKmz3dpNJpLqpj4p3QkaoGE_yKgRFIQcv.Volfqq_o4Vu_qalq

Access Passcode: Q8E@KHPm

Public Service Loan Forgiveness (PSLF)

Meeting Recording:

https://zoom.us/rec/share/Wjs6cgIG-Hqpm20p3ZhBDG9ge1bEuHcQZCXuI0B549Faa5_qtGzyQIaM99Wf7yza.OW2KODvtiE1ezpPe

Access Passcode: .&7Jg.ca

First Time Home Buyer Seminar

Meeting Recording:

https://zoom.us/rec/share/_ZykO6RLB2dfi-yI8PtlsD6ORjii0t9d1a_PR_6EC0glKBJH857NILPTgvMrKVg.zMFKPP-KE7_hBN_y

Access Passcode: XyGx.W1!

Personal Loan, Credit Card & Auto Loan presentation:

Meeting Recording:

no access passcode needed

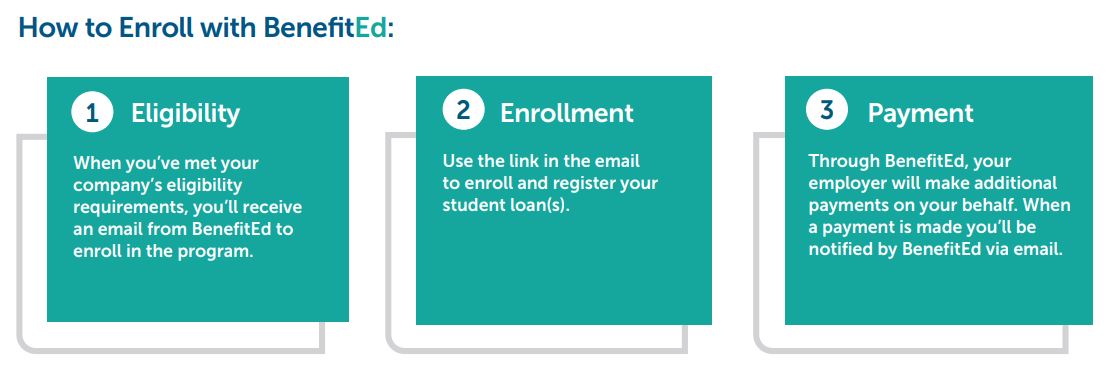

The Student Loan Repayment Program is a benefit program offered by Northeastern Vermont Regional

Hospital (NVRH), and administered by BenefitEd, as a benefit of employment. This program provides

NVRH with the ability to fund payments to an eligible employee’s student loan, taken out in their name,

for the purpose of assisting in the repayment of that loan. NVRH is offering this benefit program as an

investment into employees’ financial wellbeing.

Fulltime eligible employees will receive $150 per month. Part-time eligible employees will receive

$112.50 per month. This payment, coupled with your regular monthly payment, will help you

pay down debt faster.

Important Considerations

- Eligibility begins the first day of the month following 30 days of employment. Employees must also be benefits eligible and

provide a copy of their graduation document directly to NVRH’s HR team.

- Copies of graduation documents should be emailed to hrassist@nvrh.org by the 25th of the month in order to receive an

enrollment email from BenefitEd in the following month.

- Student loans registered for this program must be in the name of the employee and for their education.

- If enrolled by the 10th of the month, the first payment will be made on the 6th business day of the following month.

Please review the below flyer and description for more details

Helpful Resources

BENEFITED CUSTOMER SERVICE:

Email: support@youbenefited.com

Phone: 844.358.5707

Website: www.youbenefited.com/

Let St J Subaru take the hassle and some of the cost out of servicing your new or existing vehicle. NVRH employees have access to exclusive discounts from St J Subaru. See the flyer below for additional details and coupons.