Core Benefits 2025

Your Medical Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

PLEASE NOTE: The NVRH Limited Network Plan only covers services by Tier 1 Providers (NVRH Community Network Providers) and with prior approval for Tier 2 Providers (Dartmouth Hitchcock participating Network Providers). Services rendered by all other providers are not covered under the plan except emergency services, limited ancillary services such as lab, x-ray, anesthesia and certain specialties procedures approved by the Plan.

Summary of Benefits & Coverage (SBC)

Summary Plan Description (SPD)

Traveling Benefit

If a Covered Person is traveling out of state or out of country and requires emergency medical treatment from an Out-of-Network Provider (excluding when a Covered Person traveled to such location for the primary purpose of obtaining medical services, drugs or supplies), benefits shall be payable at Tier 1 Northeastern Vermont Regional Hospital In-Network Provider levels subject to Reasonable and Customary Charges.

Covered services for dependents who are full-time students residing outside the service area who receive services from participating providers will be covered at the Tier 3 benefit level. Covered emergency services for all Covered Persons traveling outside the service area will be covered at the Tier 1 benefit level.

DOCTOR ON DEMAND!

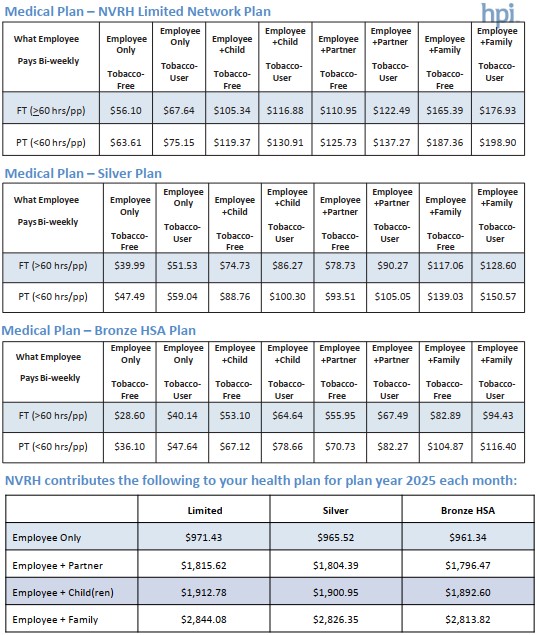

Employee Rates

NVRH is committed to helping you achieve your best health. If you’re currently a tobacco user, you can qualify for the lower premium by completing a tobacco cessation course. Contact Human Resources at 802-748-7949 to learn more and connect with a free tobacco cessation program.

Helpful Resources

Your HPI medical benefits plan includes in-network coverage, through UnitedHealthcare’s Options PPO provider network.

Forms

Prescription Drug Benefits

NVRH offers a prescription drug program through our in-house pharmacy and RxBenefits/OptumRx/DH. For the lowest cost, use the NVRH pharmacy to fill any prescriptions.

NVRH Pharmacy:

Hours: Prescriptions can only be picked up from 7:30am-8:00am (night staff) and 2:30pm-6:00pm.

NVRH wants to make requesting refills easy and convenient for our employees and their families. For more information about the current refill options, visit the Pulse page.

![]()

In addition, we have a smart phone app, RxLocal, which provides an easy way to stay connected to our pharmacy. Employees can request refills and set medicine reminders, manage all of your family’s prescriptions, and direct message (HIPAA secure) one of our pharmacists. Visit the Pulse page to download the app.

Pharmacy Benefits for NVRH Preferred & Silver:

Retail Pharmacy Program Co-pay for up to a 30-day supply

Retail Pharmacy IN NETWORK:

- Generic: $15 Preferred Brand: $25 Non-Preferred Brand: $40

Retail Pharmacy Program Co-pay for up to a 90-day supply

NVRH Pharmacy:

- $5 flat rate co-payment

Mail Order Program Co-pay for up to a 90-day supply

IN NETWORK:

- Generic: $30 Preferred Brand: $50 Non-Preferred Brand: $80

Prescription drugs will be covered at 100% with no copay when combined Rx and Medical out of pocket exceeds $6,250 single/$12,500 per family.

Pharmacy Benefit for Bronze:

Preventive prescriptions are covered at copays. All other prescriptions will be covered after the tier 1 deductible ($3,000/$6,000) has been met. You will be responsible to pay the copayment listed per prescription drug. Once the tier 3 out of pocket maximum has been met ($6,250/$12,500) prescription drugs will be covered at 100%.

Retail Pharmacy Program Co-pay for up to a 30-day supply

IN NETWORK:

- Generic: $15 Preferred Brand: $25 Non-Preferred Brand: $40

Retail Pharmacy Program Co-pay for up to a 90-day supply

NVRH Pharmacy:

- $5 flat rate co-payment

Mail Order Program Co-pay for up to a 90-day supply

IN NETWORK:

- Generic: $30 Preferred Brand: $50 Non-Preferred Brand: $80

Helpful Resources

Carrier Service Contact

RxBenefits: Retail Pharmacy Program

Customer Service: 800-334-8134

Email: customercare@rxbenefits.com

![]()

Mail Order & Specialty Pharmacy

Phone: 603-653-3785 / (855) 280-3893 (Toll Free)

To initiate mail order or review Frequently Asked Questions click the link below:

https://www.dartmouth-hitchcock.org/patients-visitors/pharmacy#dhmc

Forms

Your Health Savings Account Benefits

•Employees working a minimum of 20 hours/week and enrolled in the Bronze HSA Medical plan are eligible.

•This account is 100% employee funded and contributions can be made with pre-tax payroll deductions, if elected.

•Employees will receive a Debit Card for their HSA & may use this card to pay for bills from providers & for prescription costs at retail & mail order pharmacies

•Employees can use Health Equity’s online feature & pay providers directly online as claims from HPI are sent to Health Equity. This feature allows employees to auto-substantiate by using this online feature & pay the provider before the bill arrives.

•Employees may also invest the funds in their HSA once their account has a balance of $2,000 in it. Instructions & more information are available on Health Equity’s website.

•Funds in an HSA rollover from one year to the next & can be taken with you when employment ends.

•Employees may contribute funds into an HSA as long as they are enrolled in a Qualified High Deductible Plan

•Employees may use funds from an HSA for any medical, dental or vision qualified expense (similar to the FSA), even if they are no longer enrolled in a Qualified High Deductible Plan in the future.

•Employees may contribute up to $4,300 in 2025 if they are enrolled as a Single on the HDHP or up to $8,550 if they are enrolled with more than one person on their plan. There is a catch-up provision for employees who are over 55 of $1,000 regardless of the level at which they are enrolled.

NOTE: Employees who enroll in the HDHP & also elect to contribute to a Health Savings Account (HSA) may still elect a medical FSA, but will only be able to use funds for dental & vision expenses. This is an IRS Rule. This type of FSA is called a Limited Purpose FSA.

Helpful Resources

Carrier Service Contact

Health Equity

866-346-5800

Forms and Plan Documents

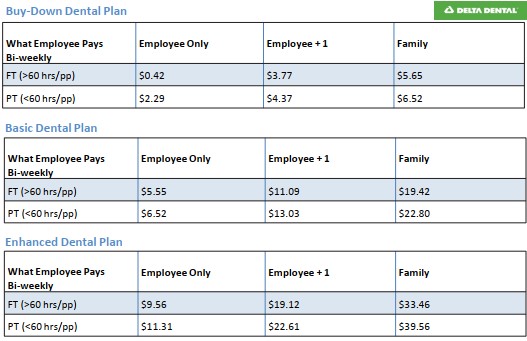

Your Dental Benefits

Eligibility:

NVRH offers 3 levels of dental coverage to eligible employees.

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Delta Dental Plans – Outline of Benefits & SPD’s

Contributions

Forms and Plan

Carrier Service Contact

Northeast Delta Dental

(800) 832-5700

Monday-Friday 8:00 am – 4:45 pm EST

Register as a Member to:

- Find a participating dentist

- Request for additional ID cards

- News and oral health education

Helpful Resources

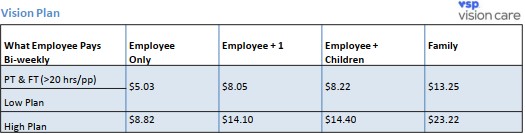

Your Vision Benefits

VSP Primary EyeCare Plans. You now have a Low & High option. Choose the plan that best fits your needs.

- Treatment for eye pain, or conditions like pink eye

- Tests to diagnose sudden vision changes

- Pictures of your eyes to detect and track eye conditions

- Exams to monitor cataracts

- Retinal Screenings

TruHearing is making hearing aids affordable by providing exclusive savings to all VSP Vision Care members. You can save up to $2,400 on a pair of digital hearing aids and savings on batteries through TruHearing.

Now you can manage your eye care needs at any time, and from anywhere. Access www.vsp.com from your smartphone.

View Exclusive Member Extras, like rebates, special offers and promotions totaling over $3,000 in savings.

- Up to 15% savings on LASIK

Eligibility:

NVRH offers vision coverage through VSP to eligible employees.

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Out-of-Network Benefits

Due to the limited number of in-network providers in your area, VSP would like to help you access your in-network benefits, even if you see an out-of-network-provider. If you are not able to see an in-network provider, call VSP at 800.877.7195 BEFORE making an appointment with an out-of-network provider. The VSP Member Services team can then assist you in obtaining reimbursement.

Contributions

|

VSP – Vision Plan Phone: (800) 877-7195 Visit the VSP website, for details on your vision coverage, claims, and to access the provider directory. Click the link below for direct access to the online Provider Directory: |

Helpful Resources

Your Flexible Spending Account Benefits

What is a Health Flexible Spending Account (FSA)?

A Health Flexible Spending Account (FSA) is a benefit that allows you to direct money to an account from your paycheck before taxes. You use the FSA money to pay for out-of-pocket health care costs, like co-pays, deductibles, dental work not covered by insurance, contacts, glasses, etc. You do not pay taxes on money directed to a Flexible Spending Account. You are saving for health care costs while saving money on taxes. The current annual maximum you may contribute to a Health FSA is determined by the IRS.

How it works:

Equal amounts deducted from paycheck before taxes.

The annual amount you choose to contribute is deducted in equal amounts, per paycheck, for the calendar year (26 pay periods).

- For example, if you chose to contribute $1,200 for the year, the pre-tax deduction from your paycheck would be $46.15 for 26 pay periods.

Total amount available for immediate use.

Even though you are contributing to an FSA per pay period, the total annual maximum you choose is available for immediate use.

- For example, if you open a FSA in the amount of $1,000.00, and you incur healthcare expenses right away, you have the total amount of $1,000.00 to use immediately.

The Benefit Debit Card.

Our health plan issues a FSA Benefit Debit Card for the total FSA amount. You may use the Benefit Card to directly pay co-payments at doctors’ offices, at pharmacies (including the NVRH Pharmacy), or use it to pay any healthcare, dental, or eye care bills, etc. It’s extremely easy to use, and you avoid having to request a reimbursement from your account. Make sure to carry the Benefit Debit Card with you!

Carry-over FSA funds.

If you do not use all of money in your Flexible Spending Account in the calendar year, up to the IRS Maximum may be carried over into the following year.

The Health FSA is an annual benefit. You must sign up for an FSA during open enrollment every year; or as a new employee when you are eligible for benefits.

Healthcare Reimbursement FSA

- The annual maximum amount you may contribute to this FSA is determined by the IRS each calendar year.

- Any unused FSA dollars at the end of the current plan year up to the IRS max may be rolled over into the following plan year to use for eligible medical expenses only. *Over-the-counter medications are not reimbursable through the FSA unless you have a prescription from your physician

Limited Purpose FSA

- Employees who enroll in the HSA Medical Plan and also elect to contribute to a Health Savings Account (HSA) may enroll in a Limited Purpose FSA. Funds in this account can only be used for dental and vision expenses. A Limited Purpose FSA has the same IRS limits, rollover and forfeitures as a Healthcare Flexible Spending Account (described above).

Dependent Care FSA

The annual maximum amount you may contribute to this FSA is $5,000 per family or $2,500 (if you are married and file a separate tax return).

For dependent care, if you have an ongoing daycare payment and wish to receive automatic reimbursements to your account, the member can send a letter to Health Plans Inc. from the provider stating the dates of service and total cost for the year along with the Direct Deposit form located under Forms on the EBC. Health Plans Inc. will process the claim as of 1/1 and each time a deposit is made to the account, the member will automatically be reimbursed.

Eligibility

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Helpful Resources

Health Plans, Inc.

Attn: Flexible Spending Dept.

PO Box 5199

Westborough, MA 01581

800-343-7674 x8416

Forms and Additional Resources

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Determine if the product you are looking for is in the eligibility list below:

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Your Group & Voluntary Life Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Contributions

Employer Paid Group Life Insurance Plan:

- NVRH pays for each eligible employee to have a Life Insurance benefit in the amount of 2 times annual salary up to a maximum of $600,000.

- The coverage becomes effective on the 1st of the month following 30 days of employment.

- Benefits are reduced to 65% at age 70 and 50% at age 75. This limit takes effect on the first January 1 that occurs while you are that age, or take effect on the day you become insured if you are then age 70.

- Coverage may be converted within 31 days of employment termination/change in eligibility for reasons other than disability or retirement. Please see the Conversion Privilege section of the Summary Plan Design for details.

Optional Life Insurance Plan:

- You can elect up to $750,000 in $10,000 increments for yourself (Cannot exceed 7 times your annual earnings). Amounts over the guaranteed issue of $300,000 will be subject to Evidence of Insurability.

- You can elect up to $250,000 in $5,000 increments for your spouse/domestic partner. Amounts over the guaranteed issue of $25,000 will be subject to Evidence of Insurability. Spouse/domestic partner benefit cannot exceed 50% of employee’s election.

- You can elect up to $10,000 in $5,000 increments for your dependent children. All amounts are guaranteed issue. A full benefit if payable for a dependent child who is 6 months to age 20, 26 if a full-time student. A reduced benefit is payable for a child from 14 days to 6 months. The dependent children benefit cannot exceed 50% of employee’s election.

Helpful Resources

Carrier Service Contact

Reliance Standard

Phone: 800-351-7500

https://customercare.rsli.com/

Group Life & AD&D and Supplemental Life Policy Number: GL-166158

Supplemental AD&D Policy Number: VAR-210403

Forms and Plan Documents

Your Disability Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Short Term Disability:

- Eligible employees may receive benefits starting on the 15th day of continuous illness or injury and ending at 26 weeks, after which long term disability may apply.

- Benefit is 75% of current base rate of pay.

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Long Term Disability:

- Eligible employees may receive benefits starting after 26 weeks.

Definition of Disability

You are disabled when Reliance Standard determines that:

- you are unable to perform the material and substantial duties of your regular occupation due to your sickness or injury;

- you are under the regular care of a doctor, and

- you have a 20% or more loss in weekly earnings due to the same sickness or injury.

Helpful Resources

Carrier Service Contact

Reliance Standard

Phone: 800-351-7500

https://customercare.rsli.com/

STD Group Policy Number: ASW-517045

LTD Group Policy Number: LTD-134150

Contributions

Short Term Disability:

NVRH pays 100% of the cost of coverage.

The weekly benefit amount is 66.7% of weekly earnings to a maximum of $2,000 per week. Your payment may be reduced by deductible sources of income and in some cases by the income you earn while disabled.

Long Term Disability:

- NVRH pays for each eligible employee to have Long Term Disability coverage.

- You must be disabled, and have a loss of income for 180 calendar days before benefits begin to pay out.

-

Benefits are 66.67% of basic monthly earnings, up to a maximum of $6,000 per month.

-

Benefit duration is up to your normal retirement age. If you become disabled at or after 65, benefits are payable according to an age-based schedule.

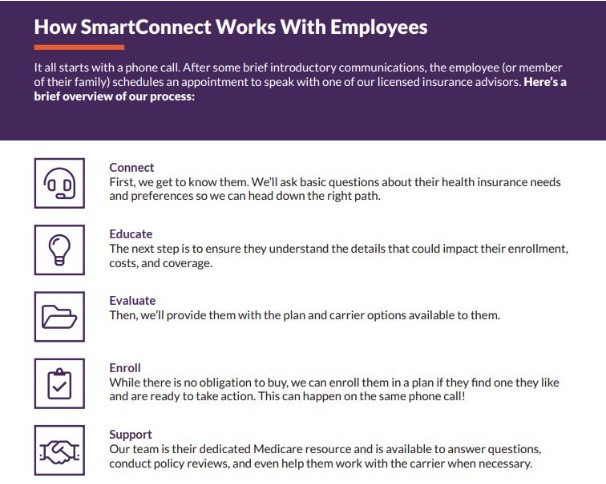

Your Medicare Resource

Northeastern Vermont Regional Hospital has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

NVRH is hosting quarterly Smart Connect webinars regarding navigating Medicare. Employees can choose to join onsite in Conference Room 127 or attend virtually by clicking the links below:

SmartConnect Contact Information

For more information or to get started, please call 833-460-5239 TTY: 711 or click on the following link: https://gps.smartwatch.com/nvrh

Your Leave Resource

Family and Medical Leave Act (FMLA) and other federal and state mandated leaves of absence are administered by AbsenceResources on behalf of NVRH. AbsenceResources will help determine eligibility, notify the employee and NVRH’s management team of leave status and tracking absences.

FMLA provides up to 12 weeks of unpaid, job protected leave for eligible employees for certain family and medical reasons.

AbsenceResources Documents & Resources

AbsenceResources Contact Information:

Call: 877-462-3652

TDD: 800-697-0353

Fax: 877-309-0218

Website: www.absenceresources.com

Email: FMLACenter@FMLASource.com