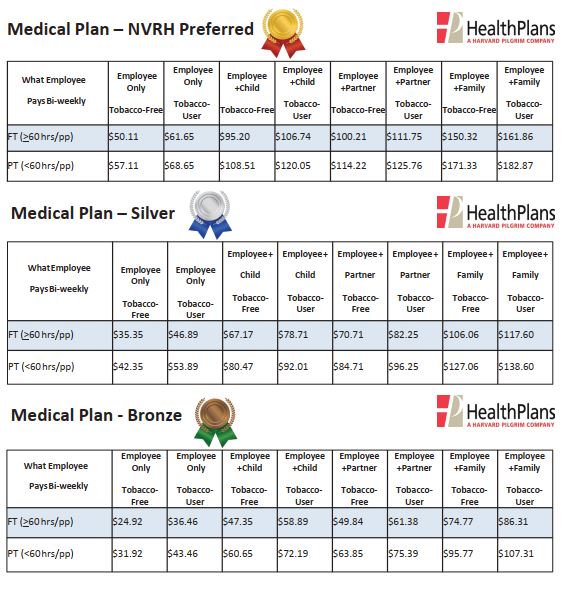

Your Medical Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

PLEASE NOTE: The NVRH Preferred plan only covers services by Tier 1 Providers (NVRH Community Network Providers) and with prior approval for Tier 2 Providers (Dartmouth Hitchcock participating Network Providers). Services rendered by all other providers are not covered under the plan except emergency services, limited ancillary services such as lab, x-ray, anesthesia and certain specialties procedures approved by the Plan.

Summary of Benefits & Coverage (SBC)

Traveling Benefit

If a Covered Person is traveling out of state or out of country and requires emergency medical treatment from an Out-of-Network Provider (excluding when a Covered Person traveled to such location for the primary purpose of obtaining medical services, drugs or supplies), benefits shall be payable at Tier 1 Northeastern Vermont Regional Hospital In-Network Provider levels subject to Reasonable and Customary Charges.

Covered services for dependents who are full-time students residing outside the service area who receive services from participating providers will be covered at the Tier 3 benefit level. Covered emergency services for all Covered Persons traveling outside the service area will be covered at the Tier 1 benefit level.

DOCTOR ON DEMAND!

Helpful Resources

Forms

Contributions & Rates

Prescription Drug Benefits

NVRH offers a prescription drug program through our in-house pharmacy and Express Scripts Inc (ESI).

Pharmacy Benefits for NVRH Preferred & Silver:

Retail Pharmacy Program Co-pay for up to a 30-day supply

Retail Pharmacy IN NETWORK:

- Generic: $15 Preferred Brand: $25 Non-Preferred Brand: $40

Retail Pharmacy Program Co-pay for up to a 90-day supply

NVRH Pharmacy:

- $5 flat rate co-payment

Mail Order Program Co-pay for up to a 90-day supply

IN NETWORK:

- Generic: $30 Preferred Brand: $50 Non-Preferred Brand: $80

Prescription drugs will be covered at 100% with no copay when combined Rx and Medical out of pocket exceeds $6,250 single/$12,500 per family.

Pharmacy Benefit for Bronze:

Preventive prescriptions are covered at copays. All other prescriptions will be covered after the tier 1 deductible ($3,000/$6,000) has been met. You will be responsible to pay the copayment listed per prescription drug. Once the tier 3 out of pocket maximum has been met ($6,250/$12,500) prescription drugs will be covered at 100%.

Retail Pharmacy Program Co-pay for up to a 30-day supply

IN NETWORK:

- Generic: $15 Preferred Brand: $25 Non-Preferred Brand: $40

Retail Pharmacy Program Co-pay for up to a 90-day supply

NVRH Pharmacy:

- $5 flat rate co-payment

Mail Order Program Co-pay for up to a 90-day supply

IN NETWORK:

- Generic: $30 Preferred Brand: $50 Non-Preferred Brand: $80

Helpful Resources

Carrier Service Contact

Express Scripts Inc, (ESI)

800-455-6906

Forms

Your Health Savings Account Benefits

•Employees are eligible to participate if enrolled in the HDHP.

•This account is 100% employee funded and contributions can be made with pre-tax payroll deductions, if elected.

•Employees will receive a Debit Card for their HSA & may use this card to pay for bills from providers & for prescription costs at retail & mail order pharmacies

•Employees can use Health Equity’s online feature & pay providers directly online as claims from HPI are sent to Health Equity. This feature allows employees to auto-substantiate by using this online feature & pay the provider before the bill arrives.

•Employees may also invest the funds in their HSA once their account has a balance of $2,000 in it. Instructions & more information are available on Health Equity’s website.

•Funds in an HSA rollover from one year to the next & can be taken with you when employment ends.

•Employees may contribute funds into an HSA as long as they are enrolled in a Qualified High Deductible Plan

•Employees may use funds from an HSA for any medical, dental or vision qualified expense (similar to the FSA), even if they are no longer enrolled in a Qualified High Deductible Plan in the future.

•Employees may contribute, in 2020, up to $3,550 if they are enrolled as a Single on the HDHP or up to $7,100 if they are enrolled with more than one person on their plan. There is a catch-up provision for employees who are over 55 of $1,000 regardless of the level at which they are enrolled.

NOTE: Employees who enroll in the HDHP & also elect to contribute to a Health Savings Account (HSA) may still elect a medical FSA, but will only be able to use funds for dental & vision expenses. This is an IRS Rule. This type of FSA is called a Limited Purpose FSA.

Helpful Resources

Carrier Service Contact

Health Equity

866-346-5800

Forms and Plan Documents

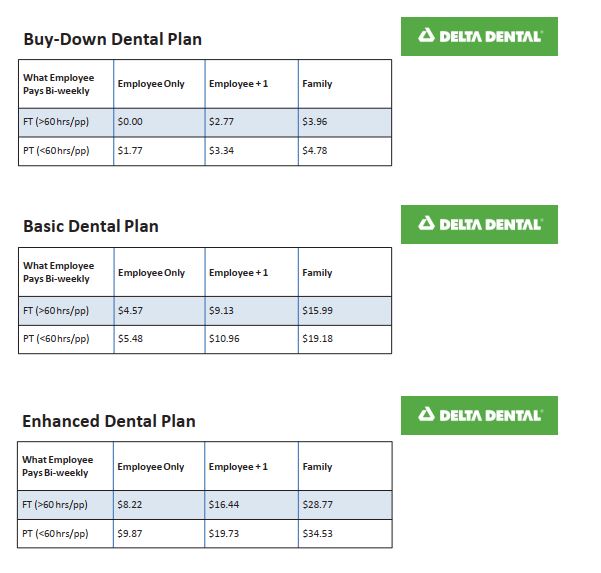

Your Dental Benefits

Eligibility:

NVRH offers 3 levels of dental coverage to eligible employees.

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Delta Dental Plans – Outline of Benefits & SPD’s

Contributions

Helpful Resources

Carrier Service Contact

Delta Dental

(800) 832-5700

Monday-Friday 8:00 am – 4:45 pm EST

Register as a Member to:

- Find a participating dentist

- Request for additional ID cards

- News and oral health education

Forms and Plan

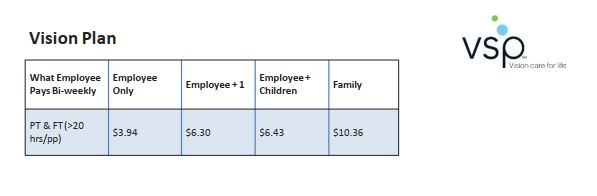

Your Vision Benefits

VSP Primary EyeCare Plan

- Treatment for eye pain, or conditions like pink eye

- Tests to diagnose sudden vision changes

- Pictures of your eyes to detect and track eye conditions

- Exams to monitor cataracts

- Retinal Screenings

TruHearing is making hearing aids affordable by providing exclusive savings to all VSP Vision Care members. You can save up to $2,400 on a pair of digital hearing aids and savings on batteries through TruHearing.

Now you can manage your eye care needs at any time, and from anywhere. Access www.vsp.com from your smartphone.

View Exclusive Member Extras, like rebates, special offers and promotions totaling over $2,500 in savings.

- Up to $500 savings on LASIK

- Extra $20 to spend on featured frame brands.

Eligibility:

NVRH offers vision coverage through VSP to eligible employees.

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Contributions

Carrier Service Contact

VSP

(800) 877-7195

Monday-Friday 8:00 am-11:00 pm EST

Saturday 9:00 am – 8:00 pm EST

TruHearing 877-396-7194 9am -9pm EST

*For a full provider directory list, please register with the instructions below on the VSP website*

Helpful Resources

Forms

Your Flexible Spending Account Benefits

Flexible Spending Accounts provide you with an important tax advantage that can help you pay healthcare and dependent care expenses on a pre-tax basis. By anticipating your family’s healthcare and dependent care costs for the next year and setting aside money, you can actually lower your taxable income.

Funding Levels for each account are:

Healthcare Reimbursement FSA

- The annual maximum amount you may contribute to this FSA is $2,700 per calendar year.

- Any unused FSA dollars at the end of the current plan year up to a $550 max may be rolled over into the following plan year to use for eligible medical expenses only. *Over-the-counter medications are not reimbursable through the FSA unless you have a prescription from your physician

Dependent Care FSA

The annual maximum amount you may contribute to this FSA is $5,000 per family or $2,500 (if you are married and file a separate tax return).

Eligibility

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Helpful Resources

![]()

Health Plans, Inc.

Attn: Flexible Spending Dept.

PO Box 5199

Westborough, MA 01581

800-343-7674 x8416

Forms and Plan Documents

Your Group & Voluntary Life Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Contributions

Employer Paid Group Life Insurance Plan:

- NVRH pays for each eligible employee to have a Life Insurance benefit in the amount of 2 times annual salary.

- The coverage becomes effective on the 1st of the month following 30 days of employment.

- Benefits are reduced to 65% at age 70 and 50% at age 75. This limit takes effect on the first January 1 that occurs while you are that age, or take effect on the day you become insured if you are then age 70.

- Coverage may be converted within 31 days of employment termination/change in eligibility for reasons other than disability or retirement. Please see the Conversion Privilege section of the Summary Plan Design for details.

Optional Life Insurance Plan:

- Additional coverage is available to all full time and part time (with benefits) employees on the 1st of the month following 30 days of employment on a voluntary employee-paid basis.

- Coverage is available on each employee, their spouse and dependent children. An employee must enroll in coverage for themselves to cover their spouse and/or children. Dependent coverage begins from 14 days, and continues to age 26.

- Employees may purchase up to $300,000 on themselves, $25,000 on their spouse and $10,000 on their dependent child(ren) with no medical questions asked when initially eligible. Coverage may be purchased above these amounts, but will require Evidence of Insurability and approval from Sun Life.

Helpful Resources

Carrier Service Contact

Sun Life Financial

Phone: 800-247-6875

8:00am-8:00pm ET, Monday-Friday

Forms and Plan Documents

Your Disability Benefits

Eligibility:

Employees who work a minimum of 20 hours per week are eligible for benefits. Benefits-eligible employees are able to enroll on the first day of the month following 30 calendar days of employment.

Short Term Disability:

- Eligible employees may receive benefits starting on the 15th day of continuous illness or injury and ending at 26 weeks, after which long term disability may apply.

- Benefit is 75% of weekly earnings

Long Term Disability:

- Eligible employees may receive benefits starting after 26 weeks.

Definition of Disability

You are disabled when Sun Life Financial determines that:

- you are unable to perform the material and substantial duties of your regular occupation due to your sickness or injury;

- you are under the regular care of a doctor, and

- you have a 20% or more loss in weekly earnings due to the same sickness or injury.

Benefit Forms

Helpful Resources

Carrier Service Contact

Sun Life Financial

Phone: 800-247-6875

8:00am-8:00pm ET, Monday-Friday

Contributions

Short Term Disability:

NVRH pays 100% of the cost of coverage.

The weekly benefit amount is 75% of weekly earnings. Your payment may be reduced by deductible sources of income and in some cases by the income you earn while disabled.

Long Term Disability:

- NVRH pays for each eligible employee to have Long Term Disability coverage.

- You must be disabled, and have a loss of income for 180 calendar days before benefits begin to pay out.

-

Benefits are 66.67% of basic monthly earnings, up to a maximum of $6,000 per month.

-

Benefit duration is up to your normal retirement age under the Social Security Act. If you become disabled at or after 65, beneftis are payable according to an age-based schedule. Please refer to the Summary Plan Description above.